Jim Rogers Net Worth: Unpacking The Legendary Investor's Wealth

Jim Rogers is a name synonymous with legendary investing, a maverick who co-founded the Quantum Fund and embarked on record-breaking global adventures. For decades, his insights into commodities, emerging markets, and global economics have captivated investors worldwide. Naturally, one of the most frequently asked questions about this financial titan revolves around his personal fortune: "What is Jim Rogers' net worth?" This article delves deep into the financial journey of Jim Rogers, exploring the sources of his wealth, his unique investment philosophy, and what his incredible career teaches us about building enduring financial success.

Understanding the precise figure of a private individual's wealth, especially one with such diverse and often non-liquid assets as Jim Rogers, is inherently challenging. Unlike publicly traded companies, private fortunes are not disclosed in quarterly reports. However, by examining his groundbreaking career, his strategic investments, and his consistent success over many decades, we can piece together a comprehensive picture of the factors contributing to Jim Rogers' net worth, offering valuable insights into the mind of a true financial pioneer.

Table of Contents

- The Maverick Investor: Who is Jim Rogers?

- Jim Rogers' Net Worth: A Deep Dive into His Wealth

- Investment Philosophy: The Pillars of Jim Rogers' Success

- Key Investments and Wealth Accumulation

- Life After Wall Street: Global Adventures and Financial Insights

- Personal Data: A Glimpse into Jim Rogers' Life

- Philanthropy and Legacy: Beyond Jim Rogers' Net Worth

- Lessons from the Legendary Investor for Your Own Financial Journey

The Maverick Investor: Who is Jim Rogers?

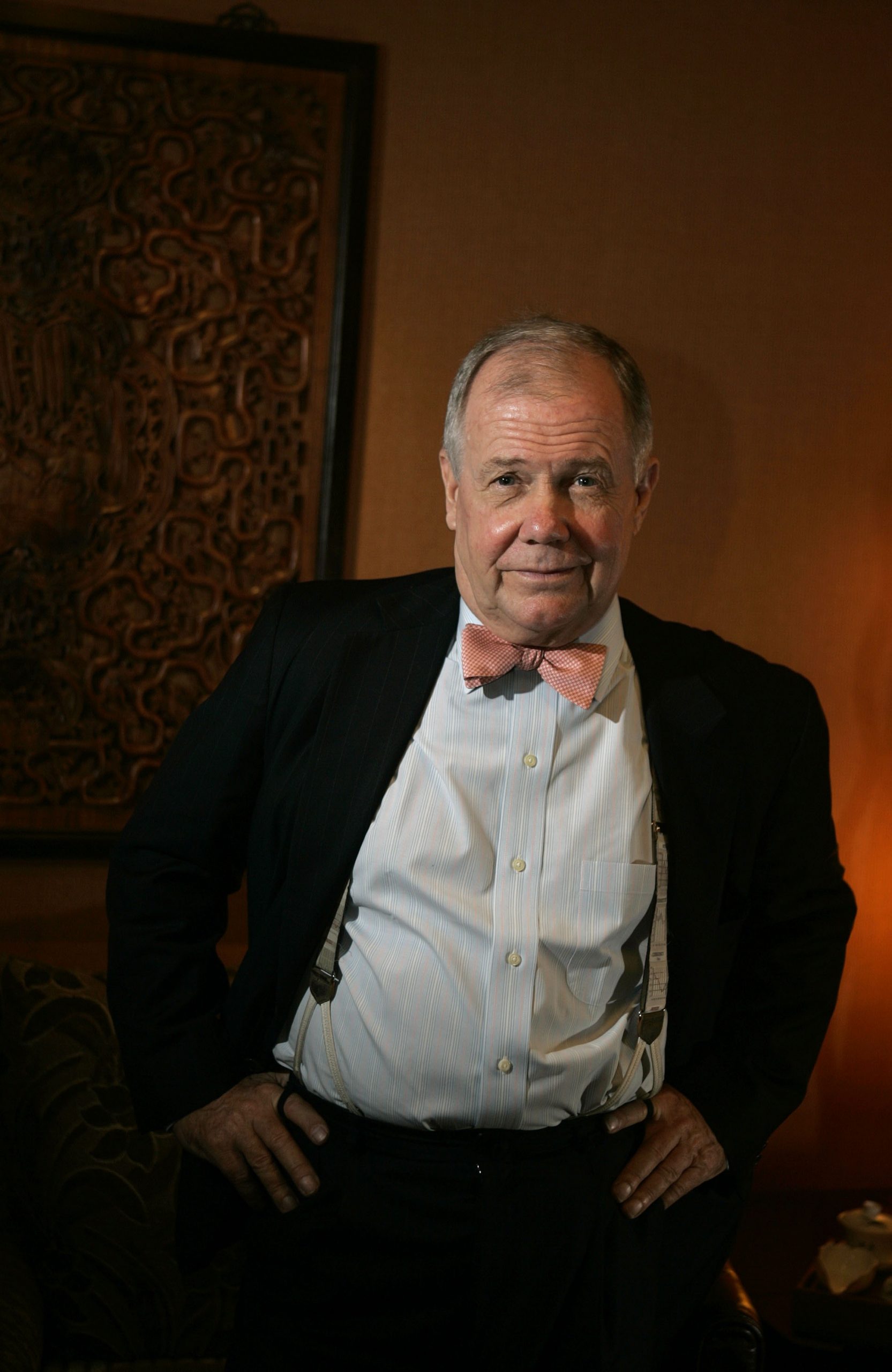

To truly appreciate the scope of Jim Rogers' net worth, it's essential to understand the man behind the fortune. James Beeland Rogers Jr., born in Baltimore, Maryland, in 1942, is far more than just an investor; he's an explorer, an author, and a profound thinker who has consistently challenged conventional wisdom in the financial world. His career trajectory is marked by audacious moves and an unwavering commitment to his unique investment philosophy.

Early Life and Education

Rogers' journey began not in the bustling financial centers but in Demopolis, Alabama, where he spent his formative years. His academic path was impressive, leading him to Yale University, where he earned a Bachelor of Arts degree in 1964. Following his undergraduate studies, he furthered his education at Oxford University (Balliol College) as a member of the elite "Skull and Bones" secret society, receiving a second B.A. in 1966. This rigorous academic background, combined with an innate curiosity, laid the groundwork for his analytical approach to markets.

His early professional life saw him briefly serve in the U.S. Army Reserve before he ventured into the world of finance. He started his Wall Street career in 1968, working at various firms, where he began to hone his skills and develop the independent thinking that would later define his success. It was during this period that he would meet the individual who would become his legendary partner.

The Quantum Fund Era

The pivotal moment in Jim Rogers' career, and arguably the foundation of his significant wealth, came in 1973 when he co-founded the Quantum Fund with George Soros. This was a revolutionary move at a time when hedge funds were far less common. The Quantum Fund was designed to be an aggressive, macro-oriented fund, taking large positions based on global economic and political trends. Rogers and Soros were pioneers in this field, employing sophisticated strategies that often involved shorting currencies, betting on commodity cycles, and exploiting geopolitical shifts.

Under their leadership, the Quantum Fund achieved an astonishing 4,200% return in its first decade, while the S&P 500 advanced only about 47%. This incredible performance cemented their reputations as two of the most brilliant minds in finance. Rogers retired from active management of the Quantum Fund in 1980 at the relatively young age of 37, having already accumulated a substantial fortune. His decision to step away from the daily grind of Wall Street at the peak of his success was unconventional, but it allowed him to pursue other passions and continue his independent research, which would further contribute to his wealth and reputation.

Jim Rogers' Net Worth: A Deep Dive into His Wealth

Estimating the precise figure of Jim Rogers' net worth is a complex task, as he is a private individual with a diverse portfolio that is not publicly disclosed. However, various financial publications and wealth trackers have attempted to quantify his fortune, often placing it in the range of several hundred million dollars. While these figures are estimates and can fluctuate significantly based on market conditions and the valuation methodologies used, they consistently point to a substantial accumulation of wealth.

It's important to note that unlike some billionaires whose wealth is primarily tied to a single, publicly traded company (like Jeff Bezos with Amazon or Elon Musk with Tesla), Jim Rogers' wealth is diversified across various asset classes, including commodities, currencies, bonds, and real estate, much of which is held privately. This diversification makes a precise calculation challenging but also speaks to the resilience and strategic nature of his financial portfolio.

How is Jim Rogers' Net Worth Calculated?

When financial outlets estimate the net worth of individuals like Jim Rogers, they typically rely on several key pieces of information and make informed assumptions:

- Publicly Known Investments: While much of his portfolio is private, Rogers has often spoken about his general asset allocation and specific interests, such as his long-standing bullish view on commodities, agriculture, and Asian markets. These broad strokes help analysts understand where his money might be.

- Historical Earnings: His share of the profits from the Quantum Fund's incredible performance between 1973 and 1980 would have been substantial, forming a significant base for his initial wealth.

- Book Royalties and Speaking Engagements: Rogers is a prolific author (e.g., "Investment Biker," "Adventure Capitalist," "A Gift to My Children") and a highly sought-after public speaker. While not the primary driver of his wealth, these income streams contribute to his overall financial standing.

- Private Holdings and Real Estate: His current residences (formerly in New York, now in Singapore) and any other private real estate or business ventures contribute to his net worth.

- Market Performance: The value of his investments fluctuates with market conditions. For instance, a strong bull market in commodities would significantly boost his estimated net worth, given his known exposure to that sector.

Given these factors, most reputable sources estimate Jim Rogers' net worth to be in the range of $300 million to $500 million. It's a testament to his astute financial decisions and disciplined approach to investing over five decades. The true figure, known only to him and his financial advisors, is likely a dynamic number that changes daily based on market valuations.

Investment Philosophy: The Pillars of Jim Rogers' Success

The substantial Jim Rogers' net worth is not merely a result of luck; it's a direct consequence of a well-defined and rigorously applied investment philosophy. Rogers is known for his contrarian views, his deep fundamental research, and his willingness to go against the herd. His approach can be distilled into several core tenets:

Contrarianism and Commodities

Perhaps the most defining characteristic of Rogers' investment style is his strong contrarian streak. He famously advises investors to "buy low and sell high" by identifying assets that are out of favor and undervalued, rather than chasing popular trends. This often means investing in sectors or countries that others are ignoring or even actively avoiding, waiting patiently for their intrinsic value to be recognized by the broader market.

His unwavering belief in commodities is another hallmark. While many investors focus solely on stocks and bonds, Rogers has long championed commodities as a vital asset class. He predicted the commodity supercycle of the early 2000s, arguing that underinvestment in natural resources combined with rising global demand (especially from emerging economies like China and India) would drive prices significantly higher. He often states that if you want to get rich, "buy agriculture and raw materials." This long-term, fundamental view on commodities has been a significant contributor to his accumulated wealth and differentiates his portfolio from many traditional investors.

Other key aspects of his philosophy include:

- Macroeconomic Analysis: Rogers is a master of understanding global economic trends, geopolitical shifts, and demographic changes. He invests based on these large-scale movements, rather than individual company fundamentals alone.

- Patience and Discipline: Once he makes an investment, he is prepared to wait years, even decades, for his thesis to play out. He avoids frequent trading and emphasizes the importance of doing thorough research before committing capital.

- Focus on What You Know: While he invests globally, he emphasizes understanding the underlying fundamentals of what you are investing in. He famously says, "I only invest in what I know."

- Emerging Markets Focus: Recognizing the long-term growth potential, he has been a vocal advocate for investing in emerging markets, particularly in Asia, long before they became mainstream investment destinations. His move to Singapore in 2007 was a testament to this belief.

Key Investments and Wealth Accumulation

Beyond the Quantum Fund, Jim Rogers has continued to build his net worth through shrewd, often unconventional, investments. His post-Quantum Fund career has been marked by personal adventures that often double as extensive market research trips, informing his investment decisions.

- Global Motorcycle Journeys: His two Guinness World Record-breaking motorcycle journeys (one in the early 1990s and another around the turn of the millennium) were not just adventures; they were immersive research expeditions. He visited over 100 countries, observing economies, infrastructure, and local cultures firsthand. These experiences reinforced his belief in the potential of emerging markets and the long-term bullish case for commodities and agriculture. He literally "rode" his way to understanding global markets, which undoubtedly informed decisions that further boosted his financial standing.

- Commodity Indices: Recognizing the lack of easily accessible investment vehicles for commodities, Rogers created the Rogers International Commodity Index (RICI) in 1998. This index, which tracks a broad basket of globally traded commodities, allows investors to gain exposure to the commodity market. While the exact financial benefit to Rogers from RICI is private, its widespread adoption and success would certainly contribute to his overall wealth.

- Agricultural Investments: He has consistently advocated for investing in agriculture, foreseeing a global food shortage and a rise in the value of farmland and food production. He has stated he owns agricultural land and related businesses, seeing them as essential long-term assets.

- Asian Markets: His move to Singapore was a strategic decision to be at the heart of what he believes will be the 21st century's economic powerhouse. He has invested heavily in various Asian markets, including China, India, and other Southeast Asian nations, often in sectors tied to infrastructure, resources, and consumption growth.

- Currencies: Rogers is known for his insights into currency markets, often taking positions based on his macroeconomic outlook. He has been particularly vocal about the future of the U.S. dollar, suggesting it might lose its reserve currency status in the long term, and has expressed interest in alternative currencies and even physical gold and silver as hedges.

These diverse investments, driven by a consistent and well-researched philosophy, have allowed Jim Rogers to not only preserve but significantly grow his net worth since his retirement from the Quantum Fund, proving that active management isn't the only path to enduring wealth.

Life After Wall Street: Global Adventures and Financial Insights

Jim Rogers' decision to "retire" from active fund management at a young age was not a retirement from finance but a shift in how he engaged with it. His life post-Quantum Fund has been marked by extraordinary global travels, prolific writing, and continuous sharing of his financial insights. This period has solidified his status as a thought leader and further contributed to his financial well-being.

His two major motorcycle journeys, chronicled in "Investment Biker" and "Adventure Capitalist," are legendary. These weren't just personal quests; they were integral to his investment strategy. By experiencing economies and cultures firsthand, he gained unique perspectives that weren't available from a desk on Wall Street. These travels allowed him to identify emerging trends, spot undervalued assets, and understand the real-world implications of global policies. For example, his observations during these trips reinforced his conviction about the rise of China and the long-term value of commodities.

Beyond his travels, Rogers has become a highly respected author and commentator. His books, including "Hot Commodities," "A Bull in China," and "A Gift to My Children," offer deep dives into his investment philosophy and provide guidance to investors. The royalties from these best-selling books, coupled with his high demand as a public speaker at conferences and universities worldwide, contribute a steady stream of income that complements his investment returns. He frequently appears on major financial news networks, offering his often contrarian and always insightful views on global markets, which keeps his name and his brand prominent in the investment community.

In 2007, Rogers made another significant move, relocating his family from New York City to Singapore. This decision was driven by his belief that the 21st century would be the "Century of Asia" and that his daughters would benefit from growing up in a region with immense future potential. Living in Asia has allowed him to be closer to the markets he believes will drive global growth, providing him with a strategic vantage point for his investments and further enhancing his ability to capitalize on regional opportunities. This strategic relocation underscores his commitment to long-term global trends, a principle that has consistently guided his path to building substantial wealth.

Personal Data: A Glimpse into Jim Rogers' Life

Here's a brief overview of Jim Rogers' personal data:

| Full Name | James Beeland Rogers Jr. |

| Born | October 19, 1942 (age 81 as of 2024) |

| Birthplace | Baltimore, Maryland, U.S. |

| Nationality | American |

| Education | Yale University (B.A.), Oxford University (Balliol College, B.A.) |

| Occupation | Investor, Author, Financial Commentator |

| Known For | Co-founding Quantum Fund, Global Motorcycle Journeys, Commodity Investing, Contrarian Views |

| Spouse | Paige Parker |

| Children | Hilton Augusta Rogers, Beeland Rogers |

| Estimated Net Worth | ~$300 Million - $500 Million (as of various estimates) |

Philanthropy and Legacy: Beyond Jim Rogers' Net Worth

While Jim Rogers' net worth is a testament to his financial acumen, his legacy extends far beyond the numbers in his bank account. He is a passionate advocate for financial literacy and critical thinking, especially among the younger generation. His book, "A Gift to My Children: A Father's Lessons for Life and Investing," is a prime example of his desire to impart wisdom and guide others toward financial independence and a deeper understanding of the world.

Rogers often speaks about the importance of understanding history, economics, and global trends, encouraging individuals to think for themselves rather than blindly following popular opinion. He has frequently emphasized the need for sound financial education in schools, believing it is crucial for future generations to navigate an increasingly complex global economy. While he may not have a publicly known large-scale philanthropic foundation like some billionaires, his contributions lie in his dedication to educating the public through his books, lectures, and media appearances. He aims to empower individuals with the knowledge and tools to make informed financial decisions, fostering a more financially literate society.

His influence on the investment world is profound. He popularized the concept of commodity investing and demonstrated the power of macro-driven, contrarian strategies. Many investors and analysts today cite his work as foundational to their understanding of global markets. His adventurous spirit and willingness to challenge the status quo have inspired countless individuals to look beyond traditional investment avenues and to seek out opportunities wherever they may lie, even if it means venturing off the beaten path. The enduring impact of Jim Rogers' insights and his unique approach to life and investing will undoubtedly continue to shape financial discourse for years to come, solidifying his place as one of the most influential figures in modern finance.

Lessons from the Legendary Investor for Your Own Financial Journey

The story of Jim Rogers' net worth is not just about accumulating wealth; it's a masterclass in strategic thinking, patience, and independent analysis. For anyone looking to improve their financial standing or simply gain a better understanding of markets, Rogers offers invaluable lessons:

- Do Your Own Research: Rogers consistently emphasizes the importance of thorough, independent research. Don't rely on headlines or popular opinion. Dig deep, understand the fundamentals, and form your own conclusions. This is a core principle behind his success.

- Be a Contrarian (When Appropriate): While not every contrarian bet pays off, Rogers has shown the immense power of buying assets when they are out of favor and selling when they are overvalued. True value often lies where others fear to tread.

- Think Globally: The world is interconnected. Understanding global economic trends, political shifts, and demographic changes can provide significant investment opportunities that are missed by focusing solely on domestic markets. His move to Asia is a prime example of this principle.

- Patience is a Virtue: Building substantial wealth, like Jim Rogers' net worth, takes time. He is known for holding investments for years, allowing his theses to play out. Avoid the temptation of short-term trading and focus on long-term growth.

- Understand Commodities: Rogers has consistently highlighted the importance of commodities as a distinct asset class. As global populations grow and resources become scarcer, understanding and potentially investing in commodities and agriculture can be a wise long-term strategy.

- Embrace Adventure and Learning: His motorcycle trips weren't just for fun; they were an extension of his learning process. Continuously seek new knowledge, explore different perspectives, and be open to unconventional ways of understanding the world.

In a world saturated with fleeting financial trends, Jim Rogers stands as a beacon of enduring wisdom. His journey, marked by intellectual curiosity, disciplined execution, and a willingness to challenge the norm, offers a powerful blueprint for anyone aspiring to achieve significant financial success and a deeper understanding of the forces that shape our global economy. While the exact figure of Jim Rogers' net worth remains private, the principles he lives by are openly shared, providing a rich source of inspiration for investors everywhere.

What are your thoughts on Jim Rogers' investment philosophy? Have his insights influenced your own financial decisions? Share your comments below, and don't forget to explore other articles on our site for more insights into legendary investors and market trends.

Jim Rogers Net Worth - Wiki, Age, Weight and Height, Relationships

Jim Rogers Net Worth - Net Worth Post

Jim Rogers Net Worth - Wiki, Age, Weight and Height, Relationships